Understanding 2K Personal Loans For Bad Credit: An Observational Resea…

페이지 정보

작성자 Tammy 댓글 0건 조회 4회 작성일 25-08-08 23:53본문

In today’s financial panorama, securing a personal loan could be a daunting process, especially for individuals with unhealthy credit score. The concept of a $2,000 personal loan for these with poor credit history is increasingly related as many seek monetary help for numerous needs, from unexpected medical bills to important automobile repairs. This observational analysis article aims to discover the dynamics surrounding $2,000 personal loans for bad credit, focusing on the challenges borrowers face, the lending landscape, and the implications of these loans on shoppers.

The Panorama of Bad Credit score Personal Loans

Dangerous credit score usually refers to a credit score rating under 580, which can end result from missed funds, excessive credit score utilization, or defaults. People with such credit scores often discover themselves in a precarious position when in search of loans, as conventional lenders like banks and credit score unions regularly impose strict requirements. Consequently, personal loans for bad credit same day payout many flip to various lending options, which embrace online lenders, peer-to-peer lending platforms, and payday loan providers.

The demand for smaller personal loans, akin to a $2,000 loan, is important, significantly for many who may not require or qualify for larger sums. These loans can serve varied functions, including consolidating debt, overlaying emergency bills, or funding small initiatives. Nonetheless, the phrases and situations associated with these loans can differ widely, and it's essential for borrowers to know what they are stepping into.

Borrower Demographics and Motivations

Our observational examine included a diverse group of borrowers seeking $2,000 personal loans with dangerous credit score. Individuals ranged from young adults struggling with scholar debt to center-aged individuals facing unexpected financial hardships. The frequent thread among these borrowers was a pressing want for instant monetary relief, often stemming from emergencies or essential expenditures.

Many participants expressed feelings of desperation and frustration on account of their credit score standing, which restricted their options. This emotional aspect is critical, because it influences decision-making. Borrowers usually reported feeling compelled to just accept unfavorable phrases simply to secure any type of financing. This highlights the vulnerability of people with unhealthy credit score, who may discover themselves at the mercy of predatory lending practices.

The Role of Online Lenders

The rise of online lending platforms has transformed the landscape for personal loans. Many on-line lenders cater particularly to individuals with bad credit score, providing streamlined purposes and faster approval instances in comparison with conventional banks. Via our observations, we noted that these platforms typically promote their providers with guarantees of fast cash and minimal requirements, which might be engaging for determined borrowers.

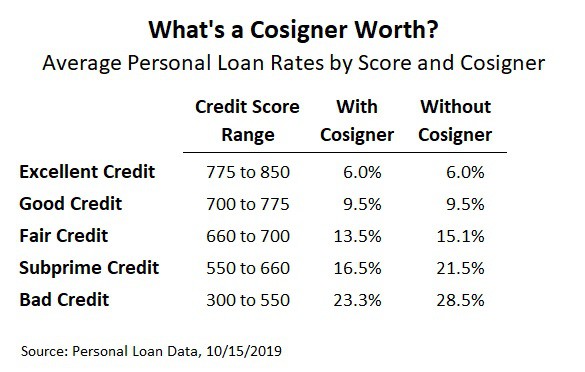

Nonetheless, whereas online lenders might provide entry to funds, they usually include greater interest charges and fees. As an illustration, a borrower with unhealthy credit might face an APR (annual share rate) ranging from 20% to 36% or even increased. This may lead to a cycle of debt, as individuals struggle to repay their loans while incurring extra curiosity costs. It's essential for borrowers to carefully assess the overall cost of borrowing earlier than committing to a loan.

The Influence of Loan Phrases on Borrowers

The phrases of a $2,000 personal loan can considerably affect a borrower’s monetary health. Many lenders provide repayment periods starting from six months to five years. Shorter phrases could lead to increased month-to-month payments, while longer phrases can result in increased overall interest costs. Our observations indicated that many borrowers most popular longer repayment intervals to scale back month-to-month monetary strain, even when it meant paying more in interest over time.

Moreover, the results of defaulting on a personal loan can be severe. Borrowers with bad credit score may already be struggling financially, and missing a cost can lead to additional fees, injury to their credit score score, and potential authorized action. This creates a precarious situation the place individuals could feel trapped in a cycle of debt, additional exacerbating their monetary difficulties.

The Significance of Monetary Literacy

Some of the placing observations from our research was the varying ranges of monetary literacy amongst borrowers. Many individuals lacked a clear understanding of their credit score scores, the implications of taking on debt, and the long-term effects of excessive-curiosity loans. This information gap typically led to poor resolution-making and elevated vulnerability to predatory lending practices.

Instructional initiatives aimed toward bettering financial literacy could play a crucial position in empowering borrowers. If you have any issues regarding where by and how to use personal loans for bad credit same day payout, you can get in touch with us at our own web site. By understanding their credit historical past, the implications of borrowing, and available alternate options, individuals could make more informed decisions regarding personal loans. Moreover, resources resembling budgeting tools and credit score counseling companies can provide invaluable support for those navigating financial hardships.

Various Options for Borrowers

While $2,000 personal loans for bad credit are a common answer, it is essential to explore various options. Borrowers might consider credit score unions, which regularly provide extra favorable terms and decrease curiosity rates in comparison with traditional lenders. Peer-to-peer lending platforms can also present alternatives for people with dangerous credit to secure loans from non-public investors who could also be extra keen to take on the chance.

Furthermore, individuals facing financial challenges should discover neighborhood sources, similar to nonprofit organizations that offer monetary help or counseling. These sources can provide assist and steerage, personal loans for bad credit same day payout serving to borrowers make informed choices and keep away from falling into the lure of excessive-interest loans.

Conclusion

The panorama of $2,000 personal loans for people with unhealthy credit is advanced and fraught with challenges. As our observational examine reveals, many borrowers face vital emotional and monetary stress whereas navigating their options. Whereas online lenders provide access to funds, they usually include high costs that may exacerbate present monetary issues.

Improving financial literacy and exploring different lending options can empower borrowers to make more informed selections and avoid predatory practices. In the end, addressing the wants of this demographic requires a multifaceted method that includes training, access to honest lending practices, and help programs to help people regain monetary stability.

댓글목록

등록된 댓글이 없습니다.